2022 tax refund calculator canada

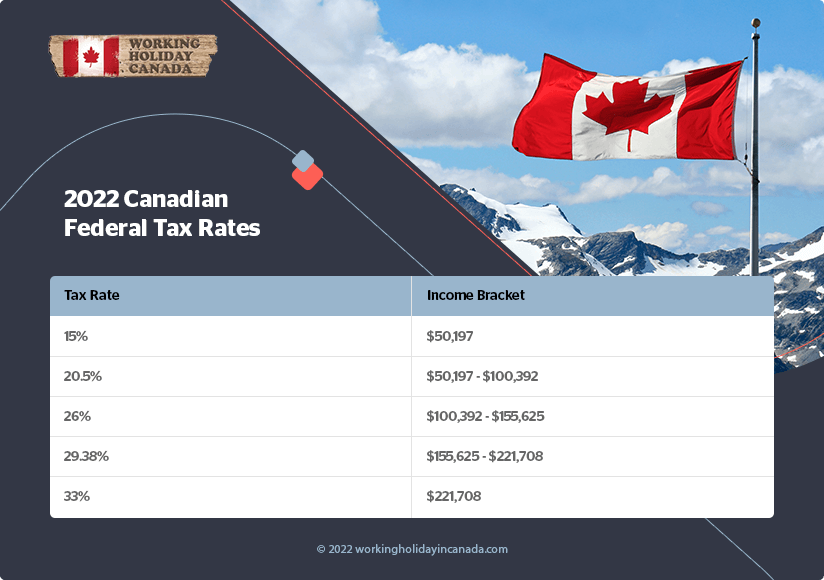

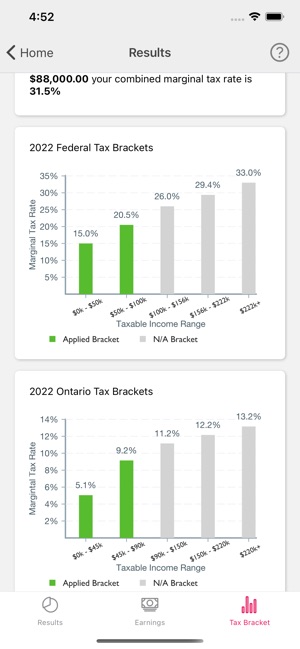

Your average tax rate is 220 and your marginal tax rate is 353. 2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory.

How To Register And Open A Cra My Account In 2022 Personal Finance Lessons Energy Saving Tips Accounting

This guarantee does not apply to TurboTax Free.

. Taxable Income Calculate These calculations do not include non-refundable tax credits other than the basic personal tax credit. Income Tax Refund Calculator Canada 2022. Tax Calculator Estimate Your Taxes and Refund for Free 2022 Tax Calculator to Estimate Your 2023 Tax Refund Start with the 2022 Tax Calculator - TAXstimator- and estimate your 2023 Tax Refund or Tax Return results.

Veja aqui Terapias Alternativas Terapias Alternativas sobre Tax refund calculator canada 2022. See how The New Equation can solve for you Todays issues Top issues Acquisitions and Divestitures Compliance. Tax Calculator Refund Estimator for 2022 IRS Tax Returns Estimated Results 0000.

This amount will be shown on Line 15000 Total Income. Personal tax calculator. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205.

This means that you are taxed at 205 from your income above 49020 80000 - 49020. Tax calculator 2022 Follow PwC Canada We are a community of solvers combining human ingenuity experience and technology innovation to deliver sustained outcomes and build trust. Employment T4 Statement of Remuneration Paid.

This marginal tax rate means that your immediate additional income will be taxed at this rate. That means that your net pay will be 40568 per year or 3381 per month. The calculator reflects known rates as of January 15 2022.

Use any of these 10 easy to use Tax Preparation Tools. Some examples of income and the slips they are reported on are. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS.

Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return. 8 rows If not 100 satisfied return within 60 days to Intuit Canada with a dated receipt for a full refund of purchase price. 2022 - Includes all rate changes announced up to June 1 2022.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Canadian corporate tax rates for active business income. 8 weeks when you file a paper return.

The Canada Revenue Agencys goal is to send your refund within. Descubra as melhores solu es para a sua patologia com Homeopatia e Medicina Natural Outros Remédios Relacionados. This tax calculator will be updated during 2022 as new 2022 IRS tax return data becomes available.

You simply put in your details get your refund estimation and then decide if you want to apply. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Calculate your combined federal and provincial tax bill in each province and territory.

Calculate the tax savings your RRSP contribution generates. If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. This handy tool allows you to instantly find out how much Canadian tax back you are owed.

Free Tax Calculator Canada 2022. 2 weeks when you file online. It all adds up to The New Equation.

Any additional income up to 98040 will be taxed at the same rate. The best starting point is to use the Canadian tax refund calculator below. These timelines are only valid for returns that we received on or before their due dates.

To calculate your refund add up your income from all sources to get your total income. The Canadian tax calculator is free to use and there is absolutely no obligation. You can also create your new 2022 W-4 at the end of the tool on the tax return result page Start the TAXstimator Then select your IRS Tax Return Filing Status.

Then get your Refund Anticipation date or Tax Refund Money in the Bank Date.

The Basics Of Tax In Canada Updated For 2022

The Basics Of Tax In Canada Updated For 2022

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

What Is A Good Rate Of Return On Investments Reverse The Crush In 2022 Investing Investing Money Income Investing

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

In The United States The Internal Revenue Service Requires That Individual Taxpayers Who Have Not Had Sufficie Inheritance Tax Tax Deductions Tax Free Savings

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips

Personal Income Tax Brackets Ontario 2021 Md Tax

Vintage 80s Small Size Toronto Blue Jays Canada Mlb Team Snapback Trucker Hat Baseball Cap In 2022 How To Wash Hats Vintage Outfits Toronto Blue Jays

Bc Income Tax Calculator Wowa Ca

The Basics Of Tax In Canada Updated For 2022

Canada Income Tax Calculator On The App Store

Forget Everything You Ve Heard About What Is A Good Cap Rate Investment Property In 2022 Real Estate Investing Real Estate Investing Rental Property Real Estate Tips

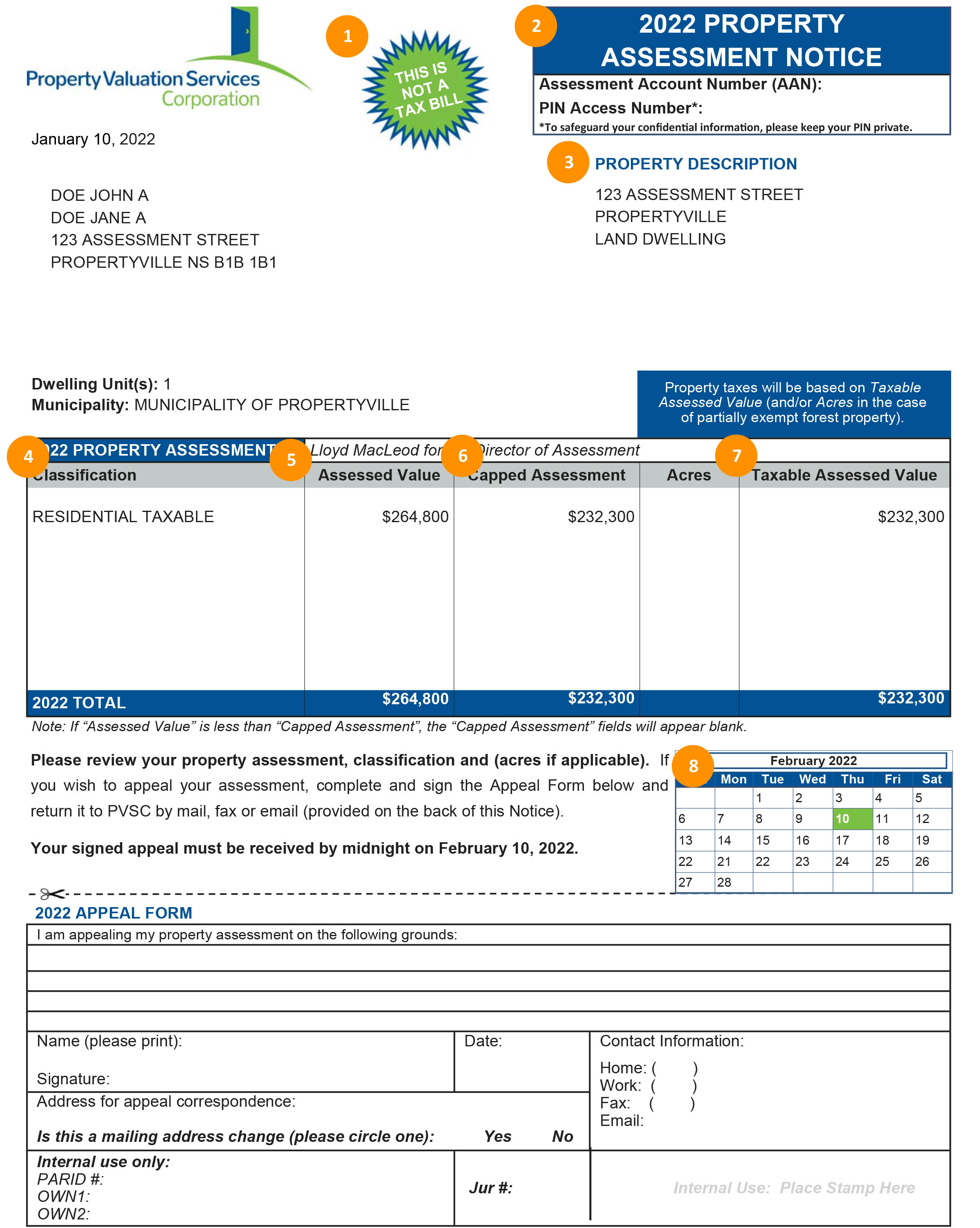

Your Property Assessment Notice Property Valuation Services Corporation